When it comes to fair housing, real estate licensees and brokers have both an ethical and a legal responsibility to their clients and customers to ensure everyone’s civil rights are protected.

When it comes to fair housing, real estate licensees and brokers have both an ethical and a legal responsibility to their clients and customers to ensure everyone’s civil rights are protected.

Civil rights laws in the real estate industry are designed to create a situation in which persons having similar financial means will have similar choices when attempting to buy, lease, rent, or finance property. The laws are also designed to allow everyone an opportunity to live in the place of his or her choice by creating an open and unbiased market.

Fair Housing law first began with the Civil Rights Act of 1866 which prohibited discrimination in housing based on race.

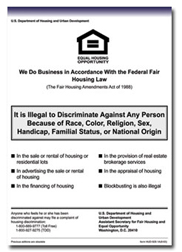

The Fair Housing Act of 1968, prohibited discrimination in housing based on race, color, religion or national origin. Jones v. Mayer ruled that discrimination on the basis of race is strictly prohibited. This means there can be NO EXEMPTIONS OR EXCEPTIONS with regard to race.

In 1974, the Housing and Community Development Act added sex to the list of protected classes.

And in 1988, the Fair Housing Amendments Act added handicap and familial status.

Any person who believes he or she has been discriminated against may file a complaint with HUD within one (1) year of the alleged act. In addition to or instead of filing a complaint with HUD, a person may file a suit in a state or federal court within two (2) years of the alleged violation.

Federal laws such as Plessy v. Ferguson (1896), Buchanan v. Warley (1917), and Brown v. Board of Education (1954) played an important role in helping to shape American civil rights policy after the passage of the original Civil Rights Act of 1866.

The Americans with Disabilities Act (ADA), which became effective in 1992, mandates that persons with disabilities have equal access to jobs, public accommodations, government services, public transportation, and telecommunications.

Fair Housing laws also prohibit these activities.

Housing discrimination has more than just a potential monetary and occupational impact on those who violate fair housing laws. When discrimination occurs, it can bring with it a host of emotional side effects:

It is the responsibility of the real estate community to see to it that we have no part in perpetrating discrimination in our marketplace. It would hopefully be our goal that all real estate agents will renew their ongoing commitment to uphold the spirit and intent of the Fair Housing Laws.

Discriminatory advertising is defined as advertising that indicates a preference, limitation or discrimination based on race, color, religion, handicap, sex, familial status, or national origin.

It’s important for licensees to view any advertising from the perspective of all the protected classes. When composing advertising, licensees should ask themselves how they would feel if they were a member of a minority and were reading the ad. This is a good guideline to help in determining whether or not the licensee should publish the ad.

The Equal Credit Opportunity Act (ECOA) prohibits lenders from discriminating against applicants on the basis of race, color, religion, national origin, sex, marital status, age, or dependency on public assistance.

The Community Reinvestment Act was passed by Congress in 1977 to prevent redlining and to encourage banks and thrifts to help meet the credit needs of all segments of their communities.

The Home Mortgage Disclosure Act of 1975 requires that lenders report statistical information each year to ensure that lenders are not restricting loans to certain individuals.

In addition to the federal fair housing laws, California also has fair housing laws and regulations that address housing discrimination:

The Fair Employment and Housing Act (FEHA) of 1963, also called the Rumford Act, specifically prohibits housing discrimination on the basis of the following:

Important definitions outlined in FEHA include:

The Unruh Civil Rights Act of 1959 provides protection from discrimination by all business establishments in California, including housing and public accommodations.

The Unruh Act provides for remedies which could include out-of-pocket expenses, a cease and desist order, or damages for emotional distress. Court-ordered damages may include a maximum of three times the amount of actual damages, but no less than $4,000 in statutory damages.

A victim of either the FEHA or Unruh Act can file a claim with the California Department of Fair Employment and Housing (DFEH) or file a private lawsuit. The complaint must be filed within one year of the alleged discrimination.

In addition to being subject to the Unruh Civil Rights Act, California financing institutions are also subject to the Housing Financial Discrimination Act of 1977, also known as the Holden Act.

The Holden Act prohibits financial institutions from discriminating in loan activities on the basis of race, color, religion, marital status, national origin, ancestry, or sex.

Discriminatory activities in real estate include refusing to sell, rent, or negotiate with any person who is a member of a protected class.

Violations of fair housing laws carry penalties and fines, so brokers must be careful about avoiding these violations.

Brokers have a responsibility to comply with fair housing policies, and they must maintain a fair housing office. Licensees share in the responsibility of complying with fair housing laws.

When answering questions from buyers and sellers, agents should always stick to the facts regarding features of a home or neighborhood. It is illegal to voice an opinion based on race, religion, color, national origin, sex, handicap, familial status, or any of the protected classes.

A real estate professional should make it clear before working with a client that his or her brokerage does take fair housing laws seriously.

If a real estate professional is asked questions about a buyer that have nothing to do with the sale, it’s important to handle the situation carefully. If a seller asks about the color, religion, ethnicity, familial status, or other “protected class” characteristics of the buyers, licensees must tell the seller it is inappropriate to give out such information.

A seller cannot withhold or refuse to show property to a "protected class" individual and the real estate professional must definitely not be involved, should this happen. If so, both the seller and the real estate professional could be sued for violating fair housing laws.

Private fair housing groups, along with government agencies, have developed an investigative tool called testing to uncover housing discrimination. Testers with similar profiles and housing needs, but different in their protected class status (for example, in race or sex), visit a real estate office and ask to see the same available unit to ascertain if they are treated differently because of this protected class status.

A tester who receives misrepresentation from renters, sellers, or real estate agents has legal standing to file a complaint under the Fair Housing Act. Cases involving testers hold the same weight and incur the same penalties as other cases of housing discrimination. Testing for fair housing compliance must be recognized as a risk and a cost of doing business.

Testing, coupled with good documentation and record keeping, can also clearly demonstrate a real estate agency's innocence when faced with a fair housing complaint.

Real estate transactions are the livelihood of the real estate industry and communities view licensees as their real estate “experts.” Given that anyone may file a discrimination complaint, it is wise for licensees to avoid any appearance of discriminatory behavior whatsoever.

Treating everyone the same is the best way to avoid fair housing complaints.

| No. | Subject | Author | Date | Views |

|---|---|---|---|---|

| 320 | Real Estate Law 99 | admin | 2019.05.16 | 208 |

| 319 | Real Estate Law 98 | admin | 2019.05.16 | 208 |

| 318 | Real Estate Law 97 | admin | 2019.05.16 | 177 |

| 317 | Real Estate Law 96 | admin | 2019.05.16 | 187 |

| 316 | Real Estate Law 95 | admin | 2019.05.16 | 793 |

| 315 | Real Estate Law 94 | admin | 2019.05.16 | 198 |

| 314 | Quiz 13 | admin | 2019.05.16 | 9774 |

| » | Chapter 13 Conclusion | admin | 2019.05.16 | 557 |

| 312 | Real Estate Law 93 | admin | 2019.05.16 | 294 |

| 311 | Real Estate Law 92 | admin | 2019.05.16 | 171 |

| 310 | Real Estate Law 91 | admin | 2019.05.16 | 1306 |

| 309 | Real Estate Law 90 | admin | 2019.05.16 | 276 |

| 308 | Real Estate Law 89 | admin | 2019.05.16 | 206 |

| 307 | Real Estate Law 88 | admin | 2019.05.15 | 262 |

| 306 | Real Estate Law 87 | admin | 2019.05.15 | 283 |

| 305 | Real Estate Law 86 | admin | 2019.05.15 | 237 |

| 304 | accrued expenses 미지급비용 | admin | 2019.05.15 | 214 |

| 303 | Quiz 12 Corrections | admin | 2019.05.15 | 492 |

| 302 | Quiz 12 | admin | 2019.05.15 | 10820 |

| 301 | Real Estate Law 85 | admin | 2019.05.15 | 264 |